Personal Savings

Get the most out of your savings.

Begin your next financial journey in Florida with a rewarding savings account. Each account earns competitive interest and features convenient money managing tools to help you reach your goals sooner.

Personal Savings

Preparing for an emergency. Planning for a vacation. Whatever your reason is for saving, we have you covered. Our personal savings accounts can help you start working toward your goals sooner and get you there faster.

Benefits of Personal Savings:

- No minimum opening deposit*

- Interest bearing on balances of $200 or more

- Online Banking1

- Mobile Banking2 and Mobile Check Deposit3

- Online Statements**

- 24-hour Automated Telephone Banking Service

*Maintain minimum daily balance of $200 to avoid the $5 Maintenance Charge.

**Enroll in Online Statements to avoid the $3 Maintenance Charge.

Help children manage their own money.

- No Maintenance Charges for account holders under 18 years of age.*

*Maintenance Charges apply when account holder turns 18.

Money Market

Our Money Market account puts your money to work for you while maintaining flexibility to access your money.

Benefits of Money Market:

- Interest bearing on balances of $2,500 or more*

- Online Banking1

- Mobile Banking2 and Mobile Check Deposit3

- Online Statements**

*Maintain minimum daily balance of $2,500 to avoid the $12 Maintenance Charge.

**Enroll in Online Statements to avoid the $3 Maintenance Charge.

Health Savings Account (HSA)

Our Health Savings Account (HSA) for both individuals and families allow people with a high-deductible health plan (HDHP) to pay for qualifying medical expenses like prescriptions, co-pays, dental care, eye care and more.

Benefits of a Health Savings Account:

- No minimum opening deposit

- Interest bearing

- No daily balance required

- Contributions are pre-tax or tax-deductible**

- Earnings grow tax-free**

Withdrawals are tax-free as long as you use them for eligible medical expenses** - Online Banking1

- Mobile Banking2 and Mobile Check Deposit3

- Online Statements*

*Enroll in Online Statements to avoid the $3 Maintenance Charge.

**Contribution limits apply. Consult a tax professional for HSA qualifications and potential tax benefits.

Time Deposit

Match your savings horizon to a time deposit, also known as a certificate of deposit (CD). Watch it mature for up to five years.

Benefits of Time Deposits:

- $500 opening deposit

- Competitive interest rates

- Interest rate will not change

- Three-month to five-year maturities available

- FDIC insured

Early time deposit contract termination penalties apply. The Bank reserves the right to enforce the full term of any time deposit. If early contract termination is agreed to by the Bank, the penalties would be applied as disclosed within the pertinent documents at date of issue.

IRA Time Deposit

Reach your retirement goals sooner with an IRA time deposit, also known as a certificate of deposit (CD).

Benefits of IRA Time Deposits:

- $500 opening deposit

- Competitive interest rates

- No opening fees of any kind

- Maturities of one to five years

- Annual statement provided

Early time deposit contract termination penalties apply. The Bank reserves the right to enforce the full term of any time deposit. If early contract termination is agreed to by the Bank, the penalties would be applied as disclosed within the pertinent documents at date of issue.

1Some restrictions may apply.

2Mobile App required. Cell phone provider may charge additional fees for web browsing and/or text messages. In order to use Mobile Banking, the browser on your mobile device must be capable of storing cookies.

3Subject to eligibility. Deposits are subject to verification. Deposit limits and other restrictions apply. Must have the Mobile App downloaded to your smart phone. Must retain check for seven days prior to destroying it. Check images will not be available online. For copies, contact us.

Blog

On Our Minds

Chart of the Day: Less and Less Shares Since 1999

April 26, 2024

Today’s Chart of the Day is from the Financial Times with a note from Callum Thomas. The chart shows that there is a shrinking level of publicly held...

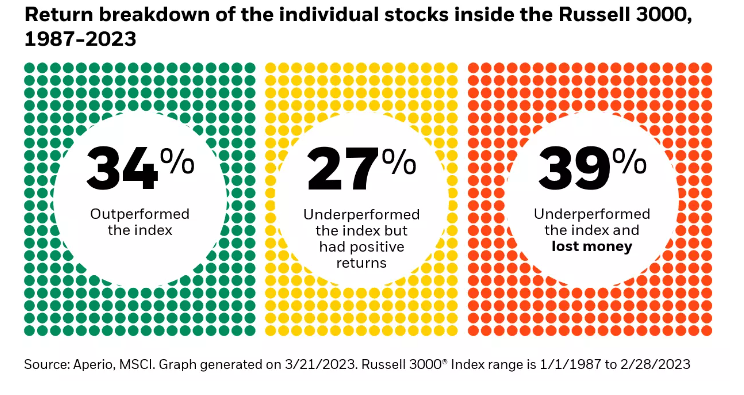

Chart of the Day: One Third

April 23, 2024

Today’s Chart of the Day from Aperio shows the percentage of individual stocks in the Russell 3000, which represents the 3,000 largest stocks in the...