Business Borrowing

Expand Your Business

Custom loans made for your business needs.

Since 1929, we’ve been helping Florida businesses like yours get the financing they need to grow. We know that no two loans are the same. Our lenders work with clients to understand their individual needs, so we can tailor a loan to fit their circumstances.

Loans subject to credit approval.

Borrowing Options

Commercial Real Estate

We offer solutions to help meet your borrowing needs with flexible terms and competitive rates.

Term Loans

Whether you’re considering a new commercial building or outgrowing your current facilities, we offer loan options that can help fund your growth.

Lines of Credit

Manage your cash flow effectively with a business line of credit.

Specialized Products

We provide specialized services for capital groups, CPAs, doctors, lawyers and more.

SEE WHY LOCAL BUSINESSES CHOOSE TO WORK WITH US.

Mac Martin, Owner of United Country & Gulfland Real Estate

Blog

On Our Minds

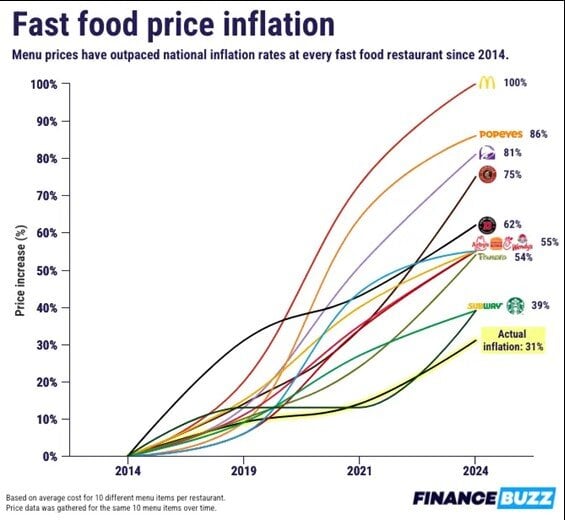

Chart of the Day: Fast Food Inflation

May 2, 2024

Today’s Chart of the Day is from Charlie Bilello with data from FinanceBuzz. It shows the inflation of fast-food prices over the last of 10 years vs....

A Time to Buy? A Time to Sell?

May 1, 2024

You may have heard the adage, “sell in May and go away,” which essentially comes from the poor performance that the markets experience during the...

%20copy.jpg?width=1920&height=882&name=pexels-anna-shvets-3727464%20(1)%20copy.jpg)